8 Present Value Models & Accrual Income Statements

Lindon Robison

Learning goals. After completing this chapter, you should be able to: (1) construct present value (PV) models that are multi-period extensions of accrual income statements (AIS); (2) demonstrate how to properly represent the financial characteristics of an investment using PV models; (3) distinguish between PV models by associating them with AIS earnings and rates of return; and (4) clarify the conditions required for earnings and rates of return on assets and equity to provide consistent rankings. These contributions are intended to help financial managers make better investment decisions.

Learning objectives. To reach your learning goals, you should complete the following objectives:

- Describe the similarities and differences between AIS and PV models.

- Demonstrate that before and after-tax rates of return on assets (ROA) and equity (ROE) derived from AIS are equivalent to before and after-tax internal rate of return on assets (IRRA) and equity (IRRE) derived from multi-period IRR models.

- Demonstrate that net present value (NPV) models can be viewed as multi-period present value extensions of EBIT, EBT, and NIAT earning measures.

- Solve NPV and IRR models using a generalized Excel template.

- Identify the conditions required for consistent earnings and rates of return on assets and equity rankings.

Introduction

The development of PV models has a long history. Some of that history is reviewed by Robison and Barry (2020). Relevant to this chapter is work by Osborn (2010), Graham and Harvey (2001), Scott and Petty (1984), and a host of other authors have focused on the possible inconsistency between NPV and IRR rankings and how to resolve the possible conflict. One resolution to the ranking conflict focused on reinvesting cash flow, producing a new class of PV models that Lin (1976) and others have referred to as modified PV models. Related to modified PV models, Beaves (1988) and Shull (1994) describe implicit and explicit reinvestment rates. Magni (2013) proposed a weighted average IRR to resolve PV and IRR inconsistencies. Robison, Barry, and Myers (2015) listed homogeneous size conditions that would guarantee IRR and NPV ranking consistency.

Recent studies have connected PV models to other disciplines. Magni (2020) linked PV models to accounting, finance, and engineering. Robison and Barry (2020) connected AIS accounting measures to PV models by noting the need to account for changes in operating accounts and liquidations of capital accounts in PV models. This chapter emphasizes that by paying attention to AIS and PV model connections we can develop more accurate and transparent PV models and better understand the possible conflict in rankings, depending on whether the focus is on assets or equity.

AIS and PV Models

Accrual Income Statements. AIS measure asset and equity earnings before and after taxes are paid. In addition, when combined with balance sheet data, AIS earning measures can estimate return on assets (ROA), equity (ROE), and after-tax return on equity (ROE(1–T)) where T is the average tax rate. AIS measure revenues and expenses when transactions occur rather than relying exclusively on when cash payments are processed or received (see Harsh, Connor, and Schwab (1981; Lazarus (1987)). To achieve this end, AIS include changes in operating and capital accounts that do not produce cash flow.

PV models defined. This paper defines PV models as multiperiod extensions of AIS. This definition applies because AIS earnings and rates of return have their corresponding measures in PV models. AIS derived ROA, ROE, and ROE(1-T) correspond to PV model derived IRRA, IRRE, and IRRE(1-T). Likewise AIS EBIT, EBT, and NIAT measures correspond to NPV for asset earnings (NPVA), equity earnings (NPVE), and after-tax equity earnings (NPVE(1-T)).

AIS and PV model differences. Despite the correspondence between AIS and PV models, there are some important differences. Consider two. First, AIS are constructed to measure a firm’s financial performance. As a result, they are often ex-post in their focus. PV models consider the financial advisability of an investment whose profitability depends on future cash flows. As a result, PV models are often ex-ante in their focus.

Second, AIS can be constructed to measure rates of return and earnings on assets and equity before and after taxes are paid in one period. PV models can be constructed to measure rates of return and earnings on assets and equity before and after tax are paid for investments that generate returns for several periods. As a result, AIS report earnings at the end of the first period. PV models report the present value of cash flow earned over several periods and the liquidated value of operating and capital accounts at the end of the analysis.

Details included in AIS and PV models. AIS and PV models correspond to and are consistent with each other. This consistency requires that we include the same detail and distinctions in PV models as we include in AIS. This requirement implies that we first need to determine if we are investigating return on assets or equity. Second, we need to account for changes in accounts receivable, inventories, accounts payable, accrued liabilities and capital accounts in both AIS as well as in PV models. Finally, to calculate rates of return on assets and equity requires asset and equity balances besides earnings data. AIS require beginning assets and equity data from balance sheets. PV models also require assets and equity data to determine how investments are supported.

AIS Earnings and Rates of Return on Assets and Equity

Earnings on assets. AIS earnings on beginning assets equals:

- the difference between cash receipts and the sum of cash cost of goods sold (COGS) and cash overhead expenses (OE), and

- changes in the value of the firm’s operating and capital accounts.

A numerical example. We illustrate how to find AIS earnings and rates of return on assets using data that describes the fictional firm Hi-Quality Nursery (HQN) described in Chapter 5. We report the AIS for HQN in Table 8.1.

| 2018 | |

| + Cash Receipts | $38,990 |

| + Change in Accounts Receivable | ($440) |

| + Change in Inventories | $1,450 |

| + Realized capital gains (losses) | $0 |

| Total Revenue | $40,000 |

| + Cash Cost of Goods Sold | $27,000 |

| + Change in Accounts Payable | $1,000 |

| + Cash Overhead Expenses | $11,078 |

| + Change in Accrued Liabilities | ($78) |

| + Depreciation | $350 |

| Total Expenses | $39,350 |

| Earnings Before Interest and Taxes (EBIT) | $650 |

| – Less Interest Costs | $480 |

| Earnings Before Taxes (EBT) | $170 |

| – Less Taxes | $68 |

| Net Income After Taxes (NIAT) | $102 |

| – Less Dividends and Owner Draw | $287 |

| Addition to Retained Earnings | ($185) |

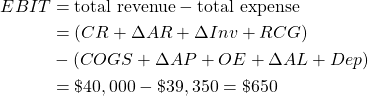

The AIS reported in Table 8.1 organizes cash flow and changes in operating and capital accounts into total revenue and total expenses and reports the difference as EBIT. The HQN EBIT calculation is summarized in equation (8.1). Total revenue equals cash receipts (CR), plus the change in accounts receivable (ΔAR), plus the change in inventory (ΔInv), plus realized capital gains (losses) (RCG). Total expenses equal the sum of cash COGS, plus the change in accounts payable (ΔAP), plus the change in cash overhead expenses (∆OE), plus the change in accrued liabilities (ΔAL), plus the change in the book value of capital assets or depreciation (Dep). EBIT represents HQN’s earnings from its beginning assets that include assets supported by its liabilities or debt.

(8.1)

Rates of return on assets. We find HQN’s ROA by dividing HQN’s EBIT of $650 by its beginning assets (A0) of $10,000 reported in Table 8.2. HQN’s ROA equals:

(8.2) ![]()

| DATE | 12/31/2017 | 12/31/2018 |

| Cash and Marketable Securities | $930 | $600 |

| Accounts Receivable | $1,640 | $1,200 |

| Inventory | $3,750 | $5,200 |

| Notes Receivable | $0 | $0 |

| Total Current Assets | $6,320 | $7,000 |

| Depreciable Assets | $2,990 | $2,710 |

| Non-depreciable Assets | $690 | $690 |

| Total Long-Term Assets | $3,680 | $3,400 |

| TOTAL ASSETS | $10,000 | $10,400 |

| Notes Payable | $1,500 | $1,270 |

| Current Portion Long-Term Debt | $500 | $450 |

| Accounts Payable | $3,000 | $4,000 |

| Accrued Liabilities | $958 | $880 |

| Total Current Liabilities | $5,958 | $6,600 |

| Non-Current Long-Term Debt | $2,042 | $1,985 |

| Total Liabilities | $8,000 | $8,585 |

| Contributed Capital | $1,900 | $1,900 |

| Retained Earnings | $100 | ($85) |

| Total Equity | $2,000 | $1,815 |

| TOTAL LIABILITIES AND EQUITY | $10,000 | $10,400 |

Earnings and rate of return on equity. We find HQN’s earnings on its beginning equity by subtracting from EBIT interest costs (Int) that represent payments for the use of debt and other liabilities and refer to the result as EBT, earnings after interest and before taxes are paid. We find ROE for HQN by dividing EBT by the firm’s beginning equity (E0) of $2,000 reported in Table 8.2. HQN’s ROE equals:

(8.3) ![]()

Earnings and changes in beginning assets and equity. EBIT and EBT earnings on the firm’s beginning assets and equity respectively. These earnings estimates may not equal the actual changes in assets and equity between periods reported in HQN’s balance sheets. To explain, the change in equity between periods reported in Table 8.2 equals ($185), ($1815 – $2,000). However, this value is not equal to EBT of $170 estimated from HQN’s AIS in Table 8.1. The difference between the change in equity and EBT can be attributed to sum of taxes paid equal to $68 and owner draw equal to $287. If we subtract taxes and owner draw from EBT, we find the change in equity between periods of ($185) equal to the actual change in equity reported in Table 8.2.

(8.4) ![]()

Table 8.3 reports a change in HQN’s assets of $400, ($10,400 – $10,000). Meanwhile, HQN’s AIS reports EBIT equal to $650. We can explain part of the difference between EBIT and the actual change in assets by accounting for interest and taxes paid and owner draw. These describe how operating activities can explain the difference between beginning and ending assets. Then if we add the effect of increased liabilities of $585, ($8585 – $8000), and the corresponding increase in assets, we explain the discrepancy. We summarize these results in the Table 8.3.

| EBIT | $650 | |

| – | Interest paid | $480 |

| – | Taxes paid | $68 |

| – | Owner draw | $287 |

| = | Change in retained earnings | ($185) |

| + | Changes in total liabilities | $585 |

| = | Change in total assets | $400 |

The main point is that while rates of return on assets and equity reflect some changes in beginning assets and equity—they do not necessarily equal the differences between beginning and ending assets and equity reported in balance sheets. Therefore, we cannot measure rates of return on assets and equity as percentage changes in ending and beginning assets and equity reported in balance sheets.

AIS and IRR Models

IRR model definition. To build an IRR model, we reorganize an AIS into cash flow and changes in operating and capital accounts. This reorganization allows us to extend an AIS into an n period IRR model by separating n periods of cash flow from the liquidation of operating and capital accounts in the nth period.

Table 8.4 divides cash flow into cash receipts (CR) and cash expenses (CE). CR include cash sales from operations, reductions in accounts receivable (∆AR < 0), reductions in inventories held for sale (∆Inv < 0) and realized capital gains (RCG). CE include cash COGS, cash OEs, reductions in accounts payable (∆AP < 0), and reductions in accrued liabilities (∆AL < 0).

| + | Cash Receipts from Operations | $38,990 |

| + | Realized Capital Gains (RCG) | $0 |

| = | Cash Receipts (CR) | $38,990 |

| + | Cash Cost of Goods Sold (COGS) | $27,000 |

| + | Cash Operating Expenses (OE) | $11,078 |

| = | Cash Expenses (CE) | $11,078 |

| CR – CE | $912 |

Table 8.5 records changes in operating accounts and depreciation. Changes in operating accounts include ∆AR, ∆Inv, ∆AP, and ∆OE. Note that we include negative changes in operating accounts that produce CR and CE cash flow. We include changes in operating accounts regardless of their sign in Table 8.5 to assure that we are measuring returns and expenses when they occur.

| + | Change in accounts receivable (∆AR) | ($440) |

| + | Change in inventories (∆Inv) | $1450 |

| – | Change in accounts payable (∆AP) | $1,000 |

| – | Change in accrued liabilities (∆AL) | ($78) |

| = | Changes in operating accounts | $88 |

| – | Depreciation (Dep) | $350 |

| = | Changes in capital accounts | $350 |

| = | Changes in operating and capital accounts | ($262) |

To summarize the calculations included in Tables 8.4 and 8.5 we express HQN’s EBIT as the sum of cash flow and changes in operating and capital accounts:

(8.5) ![]()

Notice that the sum of cash flow (CR – CE) recorded in Table 8.4 of $912 plus changes in operating and capital accounts (∆AR + ∆INV – ∆AP – ∆AL – Dep) recorded in Table 8.5 of ($262) equal EBIT of $650 reported in Table 8.1. Were the capital assets sold and their liquidation value not equal to their book value, the difference in capital accounts would be recorded as realized capital gains or losses (RCG) and included in our cash flow measure.

Finally, the EBIT estimate of change in assets minus interest costs equals EBT, the estimate of HQN’s change in equity:

(8.6) ![]()

AIS and IRRA Models

Single period IRRA models. We found ROA and ROE from an AIS by dividing EBIT and EBT by beginning assets A0 and equity E0 respectively. We follow a similar procedure when we build PV models. We must account for the beginning value of assets and equity as well as relevant changes in their ending values, including only those changes that affect EBIT or EBT. We are not interested in explaining total changes in equity and assets over the periods of analysis, but only those changes that we can attribute to operating, investing, and financing activities. To that end, we rearrange equation (8.2) and write:

(8.7) ![]()

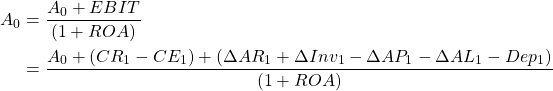

Now suppose that we add A0 to both sides of equation (8.7) and after factoring, divide both sides of equation (8.7) by (1 + ROA) to obtain:

(8.8)

We simplify equation (8.8) by substituting for A0, the value of capital accounts V0 plus the value of current asset accounts AR0 and Inv0 plus beginning cash balance Csh0.

(8.9) ![]()

We simplify equation (8.8) still more by recognizing that the value of capital assets V0 less depreciation, Dep1, equals the book value of capital assets V1book at the end of the period. However, if the capital assets are actually liquidated, then the liquidation value of capital assets can be written as V1liquidation = V0book – Dep1 + RCG. Furthermore, AR0 + ∆AR1 = AR1, and Inv0 + ∆Inv1 = Inv1. Now we can rewrite equation (8.9) as:

(8.10) ![]()

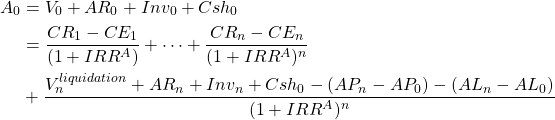

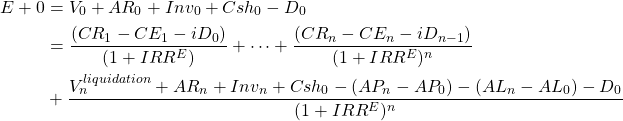

To write the multi-period equivalent of equation (8.10), we allow time subscripts to range from t = 1, …, n periods. To convert cash flow and liquidated values of noncash operating and capital accounts to their present value, we discount them by (1 + ROA). However, the discount rate in the multi-period equation is not the ROA derived from the one-period AIS but IRRA, a multi-period average internal rate of return on assets, that we substitute for ROA. We summarize our results in equation (8.11):

(8.11)

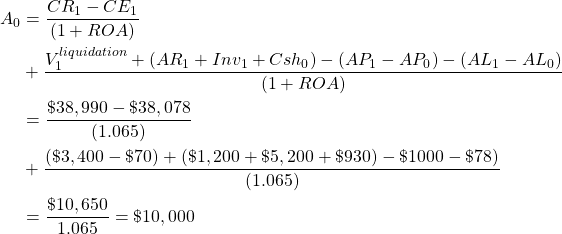

To demonstrate equation (8.11) with data from HQN, we set n=1, replace IRRA with ROA and write:

(8.12)

To explain equation (8.12), we compare the result with HQN’s AIS. We observe CR1 less CE1 produces $38,990 – $38,078 = $912 (see Table 8.1). Ending period long-term assets (LTA) equal $3,400 (see Table 8.2) from which we subtract purchases minus sales of LTA equal to $100 – $30 = $70. Ending account balances AR1 + Inv1 equal $1,200 + $5,200, and the beginning cash balance is $930. Next, we subtract changes in accounts payable of $1,000 and changes in accrued liabilities of ($78).

AIS and IRRE Models

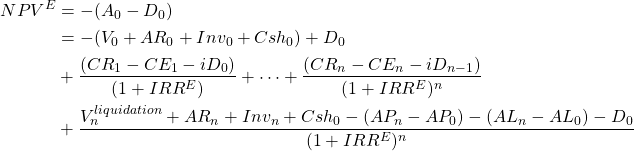

We computed ROE by subtracting from EBIT interest paid for the use of debt and divided the result by beginning equity, E0. To find the multi-period IRR for equity, IRRE, we subtract in each period t interest cost iDt–1 where Dt–1 equals the firm’s debt at the end of the previous period and i equals the average cost of debt. To find the amount of equity invested, we subtract from initial assets initial debt D0. Outstanding debt during the period of analysis collects interest. No changes in debt occur in the last period and debt at the end of the t–1st period, Dn–1, is retired in the last period. Revising equation (8.10) to account for interest costs and debt and replacing ROE with IRRE, we can find the multi-period equivalent of ROE, IRRE. We write:

(8.13)

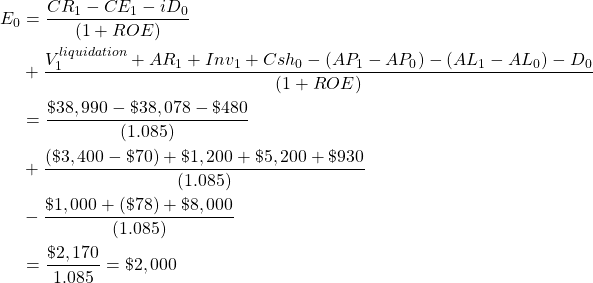

To illustrate equation (8.13) with data from HQN, we set n = 1, replace IRRE with ROE and write:

(8.14)

AIS Earnings and NPV Models

In the previous sections we derived multi-period IRRA and IRRE that correspond to ROA and ROE derived from a one period AIS and beginning assets and equity. Now we introduce multi-period NPV models that correspond to one period AIS earnings, EBIT, EBT, and NIAT. We begin by emphasizing the main difference between IRR and NPV models. IRR models find the rate of return earned by the investment or equity supporting the investment. NPV models measure the earnings realized by transferring funds from a defending investment, the investment in place, to a challenging investment, the investment being considered to replace the defending investment. Thus, NPV models convert multi-period future cash flow and changes in operating and capital accounts from a challenging investment for present dollars at the rate of one plus the defender’s IRR, (1 + IRR).

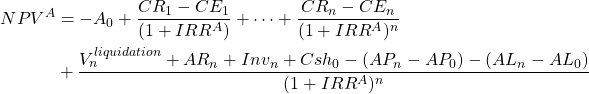

EBIT and NPVA earnings on assets. We write NPV for asset earnings by rearranging equation (8.10) and by reinterpreting IRRA as the internal rate of return on a defending investment.

(8.15)

To demonstrate equation (8.15) with HQN data, we set n = 1, replace IRRA with ROA, and write:

(8.16)

Notice that the NPVA after exchanging funds from a defender with an identical challenger is zero. But if we found NPV at the end of one period, (IRRA)(A0), the product would equal EBIT: (.065)($10,000) = $650 (see equation 8.5). These results emphasize that one important difference between AIS and NPV earnings is that AIS value earnings at the end of the period while PV models value earnings in the present. NPVs value earnings in the present because the present is where we live and make decisions. It should be obviously that if the defender’s IRR were not equal to the challenger’s IRR, then NPVA would not equal zero. For example, suppose that in equation (8.15), the defender’s IRR were 6%. Then NPVA would equal $47.17.

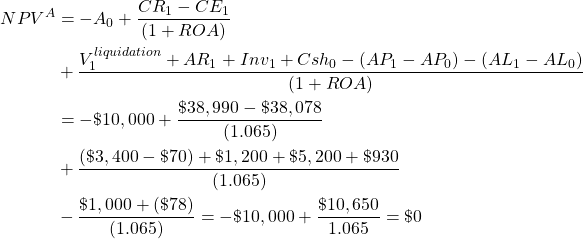

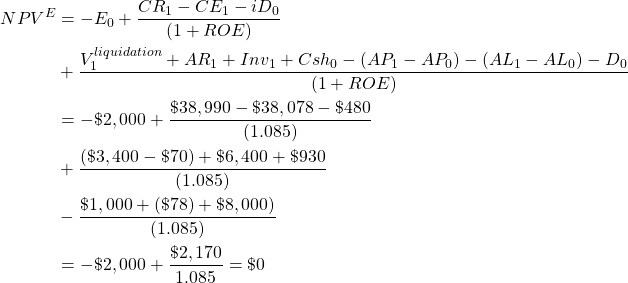

EBT and NPVE earnings on equity. We write the NPV for equity earnings by rearranging equation (8.14) and by recognizing that IRRE is the internal rate of return on equity for a defending investment.

(8.17)

To illustrate equation (8.17) with data from HQN, we set n=1, replace IRRE with ROE, and write:

(8.18)

Like the results obtained for NPVA, NPVE from exchanging funds from a defender with an identical challenger is zero. But if we found NPVE at the end of one period, (IRRE)x(E0), the product would equal EBT: (.085)x($2,0000) = $170 (see equation 8.6). It should be obvious that if the defender’s IRR were not equal to the challenger’s IRR, that NPVE would not equal zero. For example, suppose that in equation (8.18), the defender’s IRR were 8%. Then NPVE would equal $9.26.

After-tax ROE and ROA

PV models often focus on after-tax cash flow because it represents what firms/investors keep after paying all their expenses including taxes. In what follows we present tax obligations in a simplified form to illustrate their impact on earnings and rates of return. Our goal is to find the average tax rate T that adjusts ROE to ROE(1–T) and T* that adjusts ROA to ROA(1–T*). We do not try to duplicate the complicated processes followed by taxing authorities to find T and T*. Instead we suggest that the firm pays an average tax rate T or T* on EBT and EBIT respectively.

AIS report taxes paid by the firm and subtracts them from EBT to obtain NIAT. We calculate interest costs by multiplying the average interest rate i times beginning period debt Dt–1 (iDt-1) and subtract them from earnings to reduce tax obligations. As a result, NIAT represents changes in equity after both interest and taxes have been paid. In 2018, HQN paid $68 in taxes. To find the average tax rate HQN paid on its changes in equity we set taxes equal to the average tax rate T times EBT:

(8.19) ![]()

Solving for the average tax rate T that HQN paid on its earnings we find:

(8.20) ![]()

Finally, we adjust ROE for taxes and find HQN’s after-tax ROE to be:

(8.21) ![]()

AIS and After-tax ROAs. An AIS computes taxes paid by the firm on its return to equity but not on its return to assets. They record only one value for taxes paid and these estimates account for tax saving resulting from interest payments. As a result, we cannot use the average tax rate T calculated for taxes paid on equity earnings to adjust ROA for taxes. To find the average tax rate T* that adjusts ROA to ROA(1 – T*), we calculate taxes “as if” there were no interest costs to reduce the average tax rate to T*. We find ROA(1 – T*) in equation (8.16) as:

(8.22) ![]()

Solving for T* we find:

(8.23) ![]()

Equation (8.23) emphasizes an important point: adjusting ROE and ROA for taxes nearly always requires different average tax rates. The only time that T = T* is when interest costs are zero. In that case, we can easily demonstrate that T* = T since EBIT = EBT:

(8.24) ![]()

After-tax Multiperiod IRRE(1-T) Model

We are now prepared to introduce taxes into the IRRE model described in equation (8.13). We begin by solving for NIAT in equation (8.21) and replacing ROE(1-T) with IRRE(1 – T):

(8.25) ![]()

Next, we write NIAT as EBIT adjusted for both interest costs and taxes:

(8.26) ![]()

Then, we substitute for EBIT the right-hand side of equation (8.5) and for NIAT, the right-hand side of equation (8.25) and add time subscripts. The result is equation (8.27).

(8.27)  \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-49b7ea9ab462936534e0d627d4e14ea7_l3.png)

Finally, we add E0 to both sides of equation (8.27) and after factoring [1 + ROE(1 – T)] and dividing both sides of equation (8.27) by the factor, we obtain:

(8.28)  }{[1 + ROE(1 - T)]} \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-e08dd00c78140af21fc2d0fa00f7dc7a_l3.png)

Replacing E0 with Csh0 + AR0 + Inv0 + V0 – D0 in the numerator of (8.28), we can write:

(8.29) ![Rendered by QuickLaTeX.com \begin{equation*} \begin{split} E_0 & = \dfrac{Csh_0 + AR_0 + Inv_0 + V_0 - D_0 + [(CR_1 - CE_1 - Int_1)}{[1 + ROE(1 - T)]} \\ & + \dfrac{(\Delta AR_1 + \Delta Inv_1 - \Delta AP_1 - \Delta AL_1 - Dep_1)](1 - T)}{[1 + ROE(1 - T)]} \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-119471312e8fae5f5fe7de4a90faa337_l3.png)

Finally, we simplify equation (8.29) by recognizing that

(8.30) ![]()

(8.31) ![]()

(8.32) ![]()

These simplifications allow us to rewrite equation (8.29) as:

(8.33) ![Rendered by QuickLaTeX.com \begin{equation*} \begin{split} E_0 & = \dfrac{Csh_0 - D_0 + T(AR_0 + Inv_0) + (1 - T)(AR_1 + Inv_1) + V_1^{book} + TDep_1}{[1 + ROE(1 - T)]} \\ & + \dfrac{[(CR_1 - CE_1 - iD_0) - (\Delta AP_1 + \Delta AL_1)](1 - T)}{[1 + ROE(1 - T)]} \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-5b3728398140d6d5bf3d7c3f6b3a2d04_l3.png)

To verify our results, we substitute HQN numerical values into equation (8.33) and find:

(8.34) ![Rendered by QuickLaTeX.com \begin{equation*} \begin{split} E_0 & = \dfrac{\$930 - \$8,000 + [.4(\$1,640 + \$3,750)]}{(1.051)} \\ & + \dfrac{[.6(\$1,200 + \$5,200)] + (\$3,400 - \$70) + [.6(\$350)]}{(1.051)} \\ & + \dfrac{[(\$38,990 - \$38,078 - \$480) - (\$1,000 - \$78)].6}{(1.051)} = \$2,000 \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-cd2691556ced9dc22aca1d916964ee3b_l3.png)

To write the multi-period equivalent of equation (8.34) we discount n periods of operating income and in the nth period we liquidate operating and capital accounts and replace ROE(1 – T) with IRRE(1 – T).

(8.35) ![Rendered by QuickLaTeX.com \begin{equation*} \begin{split} E_0 & = \dfrac{(CR_1 - CE_1 - iD_0)(1 - T) + TDep_1}{[1 + IRR^E (1 - T)]} \\ & + \cdots + \dfrac{(CR_n - CE_n - iD_{n-1})(1 - T) + TDep_n}{[1 + IRR^E (1 - T)]^n} \\ & + \dfrac{Csh_0 - D_0 + T(AR_0 + Inv_0) + (1 - T)(AR_n + Inv_n)}{[1 + IRR^E (1 - T)]^n} \\ & + \dfrac{V_n^{book} - (AP_n - AP_0 + AL_n - AL_0)(1 - T)}{[1 + IRR^E (1 - T)]^n} \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-444afc455f6805b0e74bd27bbc5297aa_l3.png)

Capital gains (losses) and taxes. At the end of the analysis, PV models value their capital assets at their book value, or if they liquidate them, they value them at their liquidation value Vnliquidation. For tax purposes, if the difference between the liquidation and book value of capital assets is positive, (Vnliquidation – Vnbook) > 0, the firm or the investment has realized capital gains whose after-tax value is (1 – T)(Vnliquidation – Vnbook) > 0. On the other hand, if the difference is negative (Vnliquidation – Vnbook) < 0, then the firm has realized a capital loss and earned tax credits whose after-tax value loss is (1 – T)(Vnliquidation – Vnbook) < 0. To simplify the tax discussion, we ignore the tax rate differences between income, capital gains, and depreciation recapture and apply only one tax rate T, the average of all tax rates. Finally, to adjust capital accounts for taxes, we replace Vnbook in equation (8.28) with what follows:

(8.36) ![]()

Now we can write the after-tax IRRE model for changes in equity consistent with AIS construction principles.

(8.37) ![Rendered by QuickLaTeX.com \begin{equation*} \begin{split} E_0 & = \dfrac{(CE_1 - CE_1 - iD_0)(1 - T) + TDep_1}{[1 + IRR^E (1 - T)]} \\ & + \cdots + \dfrac{(CR_n - CE_n - iD_{n-1})(1 - T) + TDep_n}{[1 + IRR^E (1 - T)]^n} \\ & + \dfrac{Csh_0 - D_0 + T(AR_0 + Inv_0) + (1 - T)(AR_n + Inv_n)}{[1 + IRR^E (1 - T)]^n} \\ & + \dfrac{(1 - T)V_n^{liquidation} + TV_n^{book} - (AP_n - AP_0 + AL_n - AL_0)(1 - T)}{[1 + IRR^E (1 - T)]^n} \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-9863f28d5d520fe57b8fba3ae28ee1d1_l3.png)

After-tax Multi-period IRRA(1–T*) Model

There is no explicit measure for T* that can be used to find ROA(1 – T*). This peculiar result occurs because taxes must account for interest costs that we do not consider when finding EBIT. Yet, many applied IRR models solve for after-tax return on assets that assume we can measure ROA(1 – T*). Still, we can find such a measure from an AIS allowing us to write:

(8.38) ![Rendered by QuickLaTeX.com \begin{equation*} \begin{split} A_0 & = \dfrac{(CR_1 - CE_1)(1 - T*) + T* Dep_1}{[1 + IRR^A (1 - T*)]} \\ & + \cdots + \dfrac{(CR_n - CE_n)(1 - T*) + T* Dep_n}{[1 + IRR^A (1 - T*)]^n} \\ & + \dfrac{Csh_0 + T*Accts_0 + (1 - T*)Accts_n}{[1 + IRR^A (1 - T*)]^n} \\ & + \dfrac{(1 - T*) V_n^{liquidation} + T* V_n^{book} - (AP_n-AP_0 + AL_n - AL_0)(1-T*)}{[1 + IRR^A (1 - T*)]^n} \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-2e0ee7070db33f54c7efdf764cb84b2e_l3.png)

The main difference between equations (8.37) and (8.38) is that T is replaced with T*, interest charges are not subtracted from periodic cash flow, and initial liabilities are no longer subtracted. All these changes are required so that earnings can be attributed to beginning assets rather than beginning equity.

Although there is no explicit AIS measure corresponding to equation (8.38), we do know the value of beginning assets A0 and IRRA (1 – T*) so we can write the one period HQN numerical equivalent of (8.38) assuming capital assets are valued at their book value:

(8.39) ![Rendered by QuickLaTeX.com \begin{equation*} \begin{split} A_0 & = \dfrac{Csh_0 + T*Accts_0 + (1 - T*)Accts_1 + V_1^{book} + T* Dep_1}{[1 + ROA (1 - T*)]} \\ & + \dfrac{[(CR_1 - CE_1) - (\Delta AP_1 + \Delta AL_1)](1 - T*)}{[1 + ROA (1 - T*)]} \\ & = \dfrac{\$930 + \$565.95 + \$5,728 + \$3,330 + \$36.75}{(1.058)} \\ & + \dfrac{[(\$38,990 - \$38,078) - (\$1,000 - \$78 )].895}{(1.058)} \\ & = \$10,000 \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-512f83baaee9e9cf6335cce6d031550f_l3.png)

Rates of Return on Assets and Equity

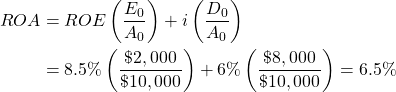

Miller and Bradford (2000) reviewed and compared rates of return on assets and equity. We agree with their conclusion that the two measures should be viewed as complementary. To describe the relationship between ROE and ROA, we begin with equations (8.2) and (8.3) that employ AIS definitions of ROA and ROE. From these two equations we deduce the rates of return identity:

(8.40) ![]()

Note that in equation (8.40) if i = ROA or if D0 = 0 then ROE = ROA. Note also that ROE and ROA are positively related. Furthermore, if we solve for ROA as a function of ROE, we find the familiar weighted cost of capital (WCC) equation that we illustrate using HQN data:

(8.41)

Of course, we are less confident about the relationships in equations (8.40) and (8.41) when measured in multi-period settings where ROA is replaced with IRRA and ROE is replaced with IRRE and interest rates and asset and debt levels may vary over time.

We emphasize that both ROA and ROE provide interesting and important information. Financial managers should be interested in what firms and investments can earn independent of how they are financed. Then, if the difference between return on assets and the cost of debt matters, as it should, ROE provides important information for choosing between alternative financing options.

Conflicting Asset and Equity Earnings and Rates of Return Rankings

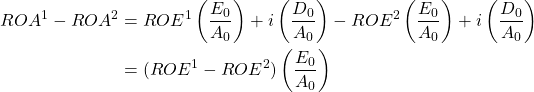

Suppose we are comparing two mutually exclusive challengers, 1 and 2, funded by the same defender and earning rates of return on invested assets of ROA1 > ROA2. Do these results imply that ROE1 > ROE2? That NPV earnings from assets invested in challengers 1 and 2 satisfy NPVA1 > NPVA2? Or, that NPV earnings from equity invested in challengers 1 and 2 satisfy NPVE1 > NPVE2?

The answer is that earnings and rates of return on assets and equity are consistent only under limited conditions. These include, A0 and E0 must satisfy homogeneity of size conditions and the average interest cost i must be the same for both investments. We demonstrate that if the homogeneity and average interest rate conditions are satisfied, then ROA1 > ROA2 implies ROE1 > ROE2, NPVA2 > NPVA1, and NPVE1 >NPVE2. To begin, recall equation (8.41) that allows us to write:

(8.42)

Therefore, if ROA1 > ROA2, then ROE1 > ROE2. Next, if ROA1 > ROA2, then from equation (8.2), it follows that EBIT1 > EBIT2 and NPVA1 > NPVA2 since:

(8.43) ![]()

Finally, if EBIT1 > EBIT2 and interest costs are the same for both investments, then EBT1 > EBT2 and NPVE1 > NPVE2 since:

(8.44) ![]()

Conflicting rankings may occur when interest rates or debt levels financing the two challengers differ. To illustrate, suppose we decided to rank challengers 1 and 2 that satisfied homogeneity of size conditions for assets and equity and whose ROA1 and ROA2 were equal. Now assume that interest costs for the two investments differed. Then we would rank the two investments based on their asset earnings and rates of return as equal. But for rankings based on equity earnings and rates of return, the investment with the lower interest cost would be preferred. The consequence is that asset-based rankings would be equal and equity-based rankings would be unequal and asset and equity-based rankings would be inconsistent.

To make clear that asset and equity earnings and rates of return may produce conflicting rankings, consider HQN’s one-period ROA of 6.5% ($650/$10,000) and its one-period ROE of 8.5% ($170/$2,000) respectively. Let HQN’s beginning assets and EBIT describe both investments 1 and 2. Now suppose that interest costs for investments 1 and 2 differed. For example, let the average interest rate charged on investment 1 be 6% and 0% for investment 2. As a result, the IRRE and NPVE rankings would no longer be consistent with IRRA and NPVA rankings for investments 1 and 2. We summarize these results in Table 8.6.

| Investment 1 | Investment 2 | |

| Asset earnings and rates of return (rankings) | ||

| NPVA (rankings) | EBIT=$650 (1) |

>EBIT=$650 (1) |

| IRRA (rankings) | $650/$10,000=6.5% (1) |

>$650/$10,000=6.5% (1) |

| Equity earnings and rates of return (rankings) | ||

| NPVE (rankings) |

EBT=$170 |

EBT=$650 |

| IRRE (rankings) |

$170/$2,000=8.5% |

$650/$2,000=32.5% |

One can imagine other less extreme cases in which asset and equity rankings could be inconsistent simply because interest cost influence earnings and rates of return on equity but not for assets.

Summary and Conclusions

We now make explicit the main point of this paper. PV models should be constructed as multi-period extensions of AIS. Otherwise, they may misrepresent the financial characteristics of investments and may lead to less than optimal investment decisions. Furthermore, different AIS earnings and rates of return help us distinguish between different NPV models and IRR. These distinctions are important since asset and earning measures on assets and equity may lead to different recommendations.

We emphasize that AIS help us recognize the conditions required for asset and equity earnings and rates of return rankings to be consistent. These insights that we learn from AIS and multi-period extensions of AIS, we believe will help financial managers better understand, build, and interpret PV models. However, these results, also task financial managers with the responsibility to carefully decide whether to base their recommendation on asset or equity earnings and rates of return.

Using the PV models developed in this paper, we can imagine financial managers building Excel templates or similar computerized support systems to solve applied investment problems that include more details than we were able to include in our demonstrations. These details may include more complete description of taxes and allow more investments and disinvestments to occur during the analysis. We wish you all success in this effort—to develop and apply PV models that represent multi-period extensions of AIS.

Questions

- How does this chapter define present value models?

- Describe two similarities and distinctions between AIS and PV models.

- Discuss the following statement. AIS find earnings at the end of the period. PV models value earnings in present dollar equivalents.

- AIS EBIT and EBT measure earnings on beginning assets and equity respectively. Do these measures equal the actual change in beginning assets and equity? If not, explain why not?

- Please consider the following statement. AIS value cash flows and liquidation of operating and capital accounts at the end of one period. IRR models find the present value of cash flow earnings over several periods and the liquidation of operating and capital account that occurs in the last period. Explain why this difference between AIS and PV models is required. (Hint: why do we limit AIS earning measures to one period while PV models find the present value of investment earnings over several periods.

- What is the main difference between IRRA models and IRRE models?

- One important difference between IRR models and NPV models is their reinvestment rate assumptions. Please describe the reinvestment rate assumptions for IRR and NPV models. What is the NPV value for IRR models?

- The cost of operating inputs is included in PV models in the period in which they are paid for with cash. Explain how depreciation estimates the cost of using up capital inputs.

- Explain the difference between the average tax rate used to find the after-tax rate of return on equity versus the average tax rate used to find the after-tax rate of return on assets. Also explain why AIS compute earnings on assets (EBIT), equity (EBT), and after-tax earnings on equity (NIAT)–but do not calculate after-tax earnings on assets?

- Using the rate of return identify find ROE if ROA=7%, beginning assets are $10,000, the average interest rate is 6%, and liabilities are 75% of assets.

- List sufficient conditions that guarantee that earnings and rates of return on asset will generate the same rankings as earnings and rates of return on equity.

- If earnings and rates of return on assets and equity provided conflicting rankings, which earnings and rates of return measures would you rely on to choose your investment, on assets or on equity? Defend your preference for either asset or equity rankings.

- Use the template described in the appendix to this chapter to find NPV on assets for the following investment.

Appendix to Present Value Models & Accrual Income Statements

Open Green & White Services Excel PV Template

A generalized NPV equation. This appendix operationalizes the concepts presented in this chapter by presenting a generalized present value (PV) template. The PV template corresponds to an accrual income statement (AIS) that measures after-tax returns on equity described in equation (8.37). To solve equation (8.37) for NPVE(1–T) using a generalized PV template, we replace beginning equity E0 with beginning assets A0 minus beginning liabilities D0 and discount future cash flow using the defender’s after-tax internal rate of return on equity IRRE(1–T) and by subtracting equity (A0 – D0) from both sides of the equation. We rewrite the results as:

(8.A1) ![Rendered by QuickLaTeX.com \begin{equation*} \begin{split} NPV^{E(1-T)} & = - (A_0 - D_0) + \dfrac{(CR_1 - CE_1 - iD_0)(1 - T) + TDep_1}{[1 + IRR^E(1 - T)]} \\ & + \cdots + \dfrac{(CR_n - CE_n - iD_{n-1})(1 - T) + TDep_n}{[1 + IRR^E(1 - T)]^n} \\ & + \dfrac{Csh_0 - D_0 + TAccts_0 + (1- T)Accts_n}{[1 + IRR^E(1 - T)]^n} \\ & + \dfrac{(1 - T)V_n^{liquidation} + TV_n^{book} - [AP_n - AP_0 + AL_n - AL_0](1 - T)}{[1 + IRR^E(1 - T)]^n} \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-206b67347b5198b06444bf8e2eb8134e_l3.png)

A generalized PV template for finding rolling earnings and rates of return on equity. We now introduce the generalized NPV template corresponding to equation (8.A1). To demonstrate the template, we use data from the Green and White Services investment problem to be introduced in Chapter 10 and represent the defender by solving HQN’s ROE, ROA, T, and T*.

|

A |

B |

C |

D |

E |

F |

G |

H |

I |

J |

K |

L |

M |

N |

O |

P |

Q |

R |

S |

T |

U |

V |

|

| 1 | Year | Assets | Debt Capital | Capital Accounts Liquidation Value | Capital Accounts book value | Depreciation (Dep=ΔE) | Asset Operating accounts (AR+INV) | Sales | Cash Receipts (CR=H+ΔG) | Liability Operating Accounts (AP+AL) | Expenses (COGS + OE) | Cash Expenses (CE=K+ΔJ) | Interest Costs (Int=ixC(t-1) | Depreciation tax savings (TxF) | After Tax Cash Flow – (I-L-M)(1-tax rate) +N + ΔC | After Tax Liquidation asset operating accounts – [G(t)-G(0)](1-tax rate) | After Tax Liquidation liability operating accounts [J(n)-J(0)]](1-tax rate) | Sum liquidating capital, operating and debt accounts = (D-E)(1-tax rate)+P-Q+E-C | Sum liquidations + last period cash flow = 0+R | Rolling after-tax NPVs | Rolling after-tax AE | Rolling after-tax IRR |

| 2 | 0 |

$40000 |

$32000 |

$40000 |

$40000 |

|||||||||||||||||

| 3 | 1 |

$0 |

$27200 |

$30000 |

$30000 |

$10000 |

$1000 |

$20000 |

$19000 |

$0 |

$9000 |

$9000 |

$1920 |

$4000 |

$4048 |

$600 |

$0 |

$3400 |

$7448 |

-$913 |

-$960 |

-6.90% |

| 4 | 2 |

$0 |

$22200 |

$15000 |

$15000 |

$15000 |

$1200 |

$30200 |

$30000 |

$0 |

$13500 |

$13500 |

$1632 |

$6000 |

$9921 |

$720 |

$0 |

-$6480 |

$3441 |

-$1033 |

-$557 |

3.03% |

| 5 | 3 |

$0 |

$17200 |

$5000 |

$5000 |

$10000 |

$800 |

$35600 |

$36000 |

$0 |

$16500 |

$16500 |

$1332 |

$4000 |

$9901 |

$480 |

$0 |

-$11720 |

-$1819 |

$3266 |

$1202 |

31.67% |

| 6 | 4 |

$0 |

$12200 |

$0 |

$0 |

$5000 |

$400 |

$39600 |

$40000 |

$0 |

$18000 |

$18000 |

$1032 |

$2000 |

$9581 |

$240 |

$0 |

-$11960 |

-$2379 |

$11411 |

$3226 |

64.79% |

Defender data obtained from HQN is represented in Table 8.A2 below.

|

A |

B |

|

|

1 |

IRRE |

0.085 |

|

2 |

T |

0.4 |

|

3 |

IRRE(1-T) |

0.051 |

|

4 |

average interest rate i |

0.06 |

Finally, we present in Table 8.A3 GWS equity generated after-tax cash flow during its four years of operation and corresponding after-tax internal rates of return.

|

A |

B |

C |

D |

E |

|

|

1 |

Economic Life |

1 year |

2 years |

3 years |

4 years |

|

2 |

-$8,000.00 |

-$8,000.00 |

-$8,000.00 |

-$8,000.00 |

|

|

3 |

$7,448.00 |

$4,048.00 |

$4,048.00 |

$4,048.00 |

|

|

4 |

-6.90% |

$3,440.80 |

$9,920.80 |

$9,920.80 |

|

|

5 |

3.03% |

-$1,819.20 |

$9,900.80 |

||

|

6 |

31.67% |

-$2,379.20 |

|||

|

7 |

64.79% |

The results of Table 8.A3 should remind us of the nature of the IRR calculation. After having calculated an investment’s IRR in year t, any positive cash flow in later periods, will increase the investment’s IRR. In the case of GWS, cash flow differ in the last year but still add to the calculated IRR value.

Detailed description of Table 8.A1. The column headings in Table 8.A1 describe exogenous and endogenous variables used to find rolling (every year) NPV and annuity equivalent (AE) estimates and correspond to variables in equation (8.A1). Highlighted data are exogenous often obtained from coordinated financial statements or projected. Data not highlighted are endogenous or calculated. Projecting values in Table 8.A1 is a subject to which we will return in Chapter 11. Now we will describe in more detail the values in Table 8.A1 and their correspondence to variables in equation (8.A1). Columns are indicated by highlighted letters in column titles.

- Column A indicates the period t at the end of which financial activity occurs and values are recorded.

- Column B line 4 lists total investment amount A0 including beginning cash C0, beginning accounts receivable and inventories (AR0 + Inv0), plus capital investments V0.

- Column C line 4 lists beginning current liabilities and noncurrent long-term liabilities D0 supporting the firm’s assets on which interest is paid. Subsequent values in Column C list the amount of outstanding liabilities in each period.

- Column D lists the liquidation value of capital investments. Since Table 8.A1 calculates rolling after-tax estimates of NPV, AE, and IRR, we are required to estimate the liquidated value of the investment in each period.

- Column E lists the book value of capital investments determined by the initial purchase price and depreciation percentages reported by taxing authorities.

- Column F calculates depreciation equal to the change in the investment’s book value.

- Column G lists the value of accounts receivable ARt and inventory Invt at the end of period t.

- Column H lists total sales during period t.

- Column I calculates cash receipts CRt in period t by adjusting total sales for changes in inventories and accounts receivable.

- Column J lists the value of accounts payable APt and accrued liabilities ALt at the end of period t.

- Column K lists expenses in period t equal to the cost of goods COGSt plus overhead expenses OEt.

- Column L calculates cash expenses CEt in period t adjusted for changes in accounts payable and accrued liabilities.

- Column M calculates interest costs iDt–1 by multiplying periodic liabilities at the end of the previous period Dt–1 by the average interest rate i.

- Column N calculates tax savings from depreciation equal to the average tax rate time depreciation in the previous period

- Column O calculates after-tax cash flow from operations in period t, equal to (CRt – CEt – iDt-1)(1–T) + TDept-1 + ∆Dt). Note that the change in outstanding debt is included because of its impact on cash flow.

- Column P calculates cash flow from after-tax liquidation of changes in asset operating accounts (ARn + Invn – AR0 – Inv0)(1 – T).

- Column Q calculates cash flow from after-tax liquidation of changes in liability operating account (APn – AP0 + ALn – AL0)(1 – T).

- Column R calculates the cash flow from after-tax liquidation of capital and asset and liability operating accounts.

- Column S sums cash flow from after-tax liquidations plus operating cash flow in the last period, required for finding rolling NPV, AE, and IRR values.

- Column T calculates rolling after-tax NPVs as though the investment ended in each year using Excel NPV equation by finding the NPV from operations and liquidations.

- Column U calculates rolling after-tax AEs associated with the after-tax NPVs for each period using Excel PMT function by finding the payment whose present value equals after-tax NPV for the corresponding period.

- Column V calculates rolling after-tax IRRs for each year using Excel IRR function. To find the annual IRRs we calculate the after-tax cash flow for each possible age of the investment reported in Table 8.A2.

Adjusting the PV template to calculate after-tax earnings and rates of return on assets. AIS statements compute earnings before interest and taxes (EBIT), earnings before taxes (EBT), and net income after taxes (NIAT). Table 8.A1 finds the PV model equivalent of NIAT. However, there is no AIS equivalent earnings measure that corresponds to after-tax NPV measures reported in Table 8.A4. This is because taxes paid are reduced by interest costs. However, in this chapter, Chapter 8, we found a method for finding the equivalent average tax rate paid on earnings from assets that enabled us to find rolling after-tax NPVs, AEs, and IRRs for assets.

To adjust equation 8.A1 to find the after-tax earnings and rates of return for assets, we set D0 equal to zero, we replace the defender’s after-tax IRR for equity IRRE(1–T) with the defender’s after-tax return on assets IRRA(1–T*), and we replace the average tax rate T on equity with the average tax rate T* on assets. The revised after-tax NPV calculation for assets is reported as equation 8.A2:

(8.A2) ![Rendered by QuickLaTeX.com \begin{equation*} \begin{split} & NPV^{A(1 - T*)} = - A_0 + \dfrac{(CR_1 - CE_1)(1 - T*) + T* Dep_1}{[1 + IRR^A (1 - T*)]} \\ & + \cdots + \dfrac{(CR_n - CE_n)(1 - T*) + T* Dep_n)}{[1 + IRR^A(1 - T*)]^n} \\ & + \dfrac{Csh_0 + T*Accts_0 + (1 - T*)Accts_n}{[1 + IRR^A (1 - T*)]^n} \\ & + \dfrac{(1 - T*) V_n^{liquidation} + T* V_n^{book} - [AP_n - AP_0 + AL_n - AL_0](1 - T*)}{[1 + IRR^A (1 - T*)]^n} \end{split} \end{equation*}](https://openbooks.lib.msu.edu/app/uploads/quicklatex/quicklatex.com-71199f68e25643234f2114d7e7179764_l3.png)

The PV template equivalent to equation 8.A2 is reported in Table 8.A4.

|

A |

B |

C |

D |

E |

F |

G |

H |

I |

J |

K |

L |

M |

N |

O |

P |

Q |

R |

S |

T |

U |

V |

|

|

1 |

Year | Assets | Debt Capital | Capital Accounts Liquidation Value | Capital Accounts book value | Depreciation (Dep=ΔE) | Asset Operating accounts (AR+INV) | Sales | Cash Receipts (CR=H+ΔG) | Liability Operating Accounts (AP+AL) | Expenses (COGS + OE) | Cash Expenses (CE=K+ΔJ) | Interest Costs (Int=ixC(t-1) | Depreciation tax savings (TxF) | After Tax Cash Flow – (I-L-M)(1-tax rate) +N + ΔC | After Tax Liquidation asset operating accounts – [G(t)-G(0)](1-tax rate) | After Tax Liquidation liability operating accounts [J(n)-J(0)]](1-tax rate) | Sum liquidating capital, operating and debt accounts = (D-E)(1-tax rate)+P-Q+E-C | Sum liquidations + last period cash flow = 0+R | Rolling after-tax NPVs | Rolling after-tax AE | Rolling after-tax IRR |

|

2 |

0 |

$40000 |

$0 |

$40000 |

$40000 |

|||||||||||||||||

|

3 |

1 |

$0 |

$0 |

$30000 |

$30000 |

$10000 |

$1000 |

$20000 |

$19000 |

$0 |

$9000 |

$9000 |

$0 |

$4000 |

$10000 |

$600 |

$0 |

$30600 |

$40600 |

-$1370 |

-$1440 |

1.50% |

| 4 | 2 |

$0 |

$0 |

$15000 |

$15000 |

$15000 |

$1200 |

$30200 |

$30000 |

$0 |

$13500 |

$13500 |

$0 |

$6000 |

$15900 |

$720 |

$0 |

$15720 |

$31620 |

-$1860 |

-$1001 |

3.03% |

| 5 |

3 |

$0 |

$0 |

$5000 |

$5000 |

$10000 |

$800 |

$35600 |

$36000 |

$0 |

$16500 |

$16500 |

$0 |

$4000 |

$15700 |

$480 |

$0 |

$5480 |

$21180 |

$2153 |

$792 |

7.63% |

| 6 | 4 |

$0 |

$0 |

$0 |

$0 |

$5000 |

$400 |

$39600 |

$40000 |

$0 |

$18000 |

$18000 |

$0 |

$2000 |

$15200 |

$240 |

$0 |

$240 |

$15440 |

$10087 |

$2851 |

14.85% |

Defender data obtained from HQN is represented in Table 8.A5 below.

|

A |

B |

|

|

1 |

IRRA |

0.065 |

|

2 |

T* |

0.105 |

|

3 |

IRRA(1-T*) |

0.0582 |

|

4 |

average interest rate i |

0.06 |

Finally, we present GWS asset generated after-tax cash flow during its four years of operation and corresponding after-tax internal rates of return.

|

A |

B |

C |

D |

E |

|

|

1 |

Economic Life |

1 year |

2 years |

3 years |

4 years |

|

2 |

-$40,000.00 |

-$40,000.00 |

-$40,000.00 |

-$40,000.00 |

|

|

3 |

$40,600.00 |

$10,000.00 |

$10,000.00 |

$10,000.00 |

|

|

4 |

1.50% |

$31,620.00 |

$15,900.00 |

$15,900.00 |

|

|

5 |

3.03% |

$21,180.00 |

$15,700.00 |

||

|

6 |

7.63% |

$15,440.00 |

|||

|

7 |

14.85% |

- The material in this chapter was adapted from Robison, L.J. and P.J. Barry (2020). “Accrual Income Statements and Present Value Models.” Agricultural Finance Review. ↵