21 Epilogue: One Thing More…

Lindon Robison

Learning goals. After completing this chapter, you should be able to: (1) understand that, as humans, our needs include socio-emotional goods as well as those goods that can be purchased with money; and (2) that our needs motivate us to allocate resources to achieve both economic as well as socio-emotional goals.

Learning objectives. To achieve your learning goals, you should complete the following objectives:

- Learn the difference between “econs” and “humans”.

- Be reminded of the five distinct motives for pursuing a goal.

- Learn the difference between commodities and relational goods.

- Learn why humans exchange goods on terms and levels that econs view as irrational.

- Learn how including relational goods in our models explains exchanges that many econs would call irrational.

Introduction

The famous Beatles singing group titled one of their hit songs, “Can’t Buy Me Love.” While coming from an unlikely source of philosophical insight, their song title did proclaim an important truth: money can’t buy love nor most any other goods whose value depends on relationships. So, the purpose of this chapter is to remind us that relationships and the intangible goods produced in relationships may be our most important resources that need careful managing.

Econs versus humans. The behavioral economist Richard Thaler (2008) described two types of decision makers: “econs” and “humans.” Econs, according to Thaler, make decisions like persons described in graduate school economic textbooks. They are perfectly selfish, possess perfect information about the outcome of their choices, and their will power is absolute. Humans, on the other hand, fail to satisfy any of those assumptions. Their choices are influenced by relationships with other humans that lead them to unselfish choices. They lack complete information about the outcomes of their choices and about alternative choices. Finally, they sometimes overeat, drink too much, and also often don’t follow through on their choices.

Motives. A homework question at the end of Chapter 1 asked you what are your motives for wanting a college degree? The list of possible motives are reported below.

- I want a college degree so I can increase my lifetime earnings and get a better job.

- I want a college degree so important people in my life will be pleased with my achievements.

- I want a college degree to live up to the expectations I have for myself.

- I want a college degree so I will feel part of groups to which I want to belong.

- I want a college degree so that, in the future, I will be better able to help others.

An econ would have said that 100% of his or her motive was to increase lifetime earnings. Assuming your responses were not those of an econ, then you undoubtedly make decisions like a human. Your selection of motives can be used to infer that you care about and are motivated by other considerations than your desire to obtain a college degree to increase your potential income. The evidence from past surveys supports the conclusion that we are all human.

Anomalies

One outcome of managers behaving like humans instead of econs is that we observe behavior that is inconsistent with the prediction of profit and net present value (NPV) maximizing behavior associated with econs. One such example occurs regularly in the sale and purchase of farmland. Some of the anomalies we observe in the farmland market include terms and level of trade and selection of trading partners that depend on relationships, unselfish exchanges where sellers sacrifice higher prices for lower ones, and prefer to sell to friends and family rather than strangers and unfriendly neighbors.

To illustrate anomalies in the U.S. farmland markets, consider the minimum sell price of land. Compared to the arm’s length market price, fifteen hundred farmland owner-operators in Illinois, Michigan, and Nebraska were surveyed. They reported discounting farmland prices to friends and family members by 5.57% and 6.78% respectively. These same owner-operators reported that they would require a minimum sell price premium of 18.4% to sell their land to their unfriendly neighbors (Siles, et. al., 2000).

Another farmland market study found that strangers entering the Linn County, Oregon, farmland market were at a decided disadvantage because they were forced to rely on public advertisements and Realtors to gain access to farmland sales information. Friendly neighbors and family of sellers accessed farmland purchase opportunities directly from the sellers. One consequence of this differential information access was that a stranger buying an 80-acre parcel of Class II non-irrigated farmland though a Realtor was projected to pay $2,535 per acre while a neighbor of the seller buying the same land was projected to pay 20% less (Perry and Robison, 2001).

Finally, as a result of premiums and discounts and preferential access to farmland markets that depend on relationships, farmland sellers reported that less than 2% of their sales were to unfriendly neighbors while up to 70% of land sales were to friendly neighbors and family. Others reported similar observations in which relationships altered the terms and level of farmland trades. Indeed, terms and level of trade and selection of trading partners in farmland exchanges that are not influenced by relationships have a special name, “arm’s length sales.”

How do we explain the regular anomalies we observe in farmland markets? One explanation follows. Econs trade and consume only commodities. Humans trade and consume both commodities and relational goods. When we ignore relational goods in human exchanges and consumption, the results appear as anomalies. Consider next the nature of relational goods.

Commodities and Relational Goods

Expanding the decision maker’s choice set. For the most part, economic theory focuses on physical goods and services that decision makers obtain for themselves and whose values do not depend on their connection to a particular person(s). We call these goods commodities. Describing this focus on commodities, Becchetti, Pelloni and Rossetti (2008) wrote: “in mainstream economics agents are mostly considered in isolation as they impersonally interact through markets, and consumption goods and leisure are assumed to be ‘sufficient statistics’ of their utility.”

Nothing in economic theory, however, prevents us from expanding the set of properties used to describe goods in decision makers’ choice sets. For example, we could add the goods’ relational properties to the description of those goods. Relational properties of goods include the identity of persons who produce, exchange, consume, and store goods in the choice set. Furthermore, this added description of goods could be justified if it were shown that decision makers’ preference ordering depended on the relational properties of goods.

Social scientists in the past have connected a good’s relational properties to its preference orderings (Bruni and Stanca, 2008). Indeed, Adam Smith may have foreshadowed the concept of relational goods when he described fellow-feeling or sympathy as essential for human happiness.

Emphasizing that the identity of exchange partners matters when defining relational goods, Uhlaner (1989) wrote, “goods which arise in exchanges where anyone could anonymously supply one or both sides of the [exchange] are not relational”. Luigino and Stanca (2008) concluded in their review of relational goods that “genuineness” is foundational, and the identity of the other person is essential for the value, and in some cases even for the existence, of the relational good. Gui and Sugden (2005) defined relational goods as “the affective components of interpersonal relations [that] are usually perceived as having value through their sincerity or genuineness”.

Defining relational goods. Relational goods are those goods whose value depends at least in part on their connections to people who produce, exchange, consume, and store them. Three concepts describe relational goods. The flow of relational goods is called socio-emotional goods (SEG). The stock or inventory of relational goods is called attachment value goods (AVG). SEG embedded in persons are said to create investments in social capital (Robison and Flora, 2003). Finally, social capital is required to produce SEG. We describe these, SEG, AVG, and social capital, in more detail in what follows.

SEG are intangible goods that satisfy socio-emotional needs. While there is no universally accepted list of socio-emotional needs that relational goods are expected to satisfy, generally accepted needs include the need for internal validation or self-actualization, the need for external validation, the need for connectedness (belonging, love and friendship), and the need for knowing (Robison, Schmid, and Siles, 2002). SEG differ from other intangible goods and services because they are produced by social capital—sympathy (empathy), regard, or trust that one person has for another person or group.

SEG like other intangible goods can become attached to, associated with, or embedded in durable goods and change the meaning and value of the durable goods they act on. Durable goods embedded with SEG are called attachment value goods (AVG) and represent a stock of SEG. Since SEG and AVG “spring out of interpersonal relationships, and comprise the often intangible, interpersonal side of economic interactions”, they qualify as relational goods (Robison and Ritchie, 2010).

In mainstream economics, the production of commodities employs manufactured capital (tools and implements), natural capital, human capital, and financial capital. All of these contribute to the creation of a good or service valued for its mostly observable physical properties. In contrast, relational goods are produced in sympathetic (empathetic), trusting, and high regard relationships referred to here and by others as social capital. While there are other definitions of social capital, many of these do not satisfy the requirement of being capital or social. Instead they focus on where social capital lives (networks), what it can produce (cooperation), the rules that organize its use (institutions) and how to produce it (Robison, Schmid and Siles, 2002).

Human needs are satisfied by commodities and relational goods. The distinguishing properties of commodities and relational goods are described next.

Distinguishing properties of commodities. The properties that describe commodities have little or no connection to people or relationships among people and are described next. (1) Commodities are exchanged in impersonalized markets. (2) The terms and level at which commodities are exchanged are determined by the aggregate of market participants and apply generally. (3) Commodities are standardized goods of uniform quality which makes them perfect substitutes for each other so that little or no connection exists between their value and those who produce, exchange, consume, and store them. (4) The value of commodities can be inferred from their (mostly) observable properties. (5) Manufactured, natural, human, and financial capital may all play an important role in the production of commodities. (6) The value of commodities can be altered by changing their form, function, location, or other physical properties. (7) Commodities satisfy mostly physical needs and wants. (8) Commodities are mostly nondurable goods not likely to become embedded with SEG because of their short useful lives. (9) Commodities are most likely to have their quantity and quality certified by arm’s length agencies established for that purpose.

Distinguishing properties of relational goods. The properties that describe relational goods are wholly or partially dependent on the good’s connection to people who produce, exchange, consume, and store them and are described next. (1) Relational goods are exchanged in personalized settings in which either the buyer or the seller or both are known to each other. (2) The terms and level of relational goods exchanged are influenced by the social capital inherent in the relationships of those producing, exchanging, consuming, and storing them. (3) Relational goods are poor substitutes for each other because they are produced in unique relational settings. (4) The value of relational goods depend on their mostly unobservable intangible properties. (5) While other forms of capital may be used in their production, relational goods cannot be produced without social capital. (6) The value of relational goods can be altered by changing their connections to people who produce, exchange, consume, or store them. (7) Relational goods satisfy mostly socio-emotional needs and wants. (8) Relational goods are mostly durable goods likely to become embedded with SEG because of their extended useful lives. (9) Relational goods are not likely to have their quantity or quality value certified by arm’s length agencies established for that purpose.

We summarize the differences between commodities and relational goods in Table 21.1.

Table 21.1. Properties of commodities and relational goods.

| Property | Commodities | Relational goods |

| 1. Exchange setting. | Impersonal setting in which buyer and seller are not known to each other. | Personalized setting in which buyer and seller are connected through a social relationship. |

| 2. How terms and level of exchange are determined. | Terms and level of goods exchanged are determined by the aggregate influence of market participants. | Terms and level of goods exchanged are uniquely determined by the social capital inherent in the persons engaged in the exchange. |

| 3. Substitutability of goods. | Standardized goods with uniform quality which allows one commodity to substitute for another. | Unique good with few substitutes because its value is uniquely determined by the social capital involved in its exchange. |

| 4. Value determining properties. | Mostly observable, physical properties. | Mostly unobservable intangible SEG exchanged directly or embedded in an AVG. |

| 5. Capital used in their production. | Manufactured, natural, human, and financial capital may all be important in the production of commodities. | While other forms of capital may be used, social capital is required in the production of relational goods. |

| 6. How the value of the good is changed. | Value is altered by changing the physical properties of the good including its form, function, location, taste, color, and other physical properties. | Value is altered by humanistic acts that produce SEG that may lead to increased investments in social capital or that may become embedded objects creating AVG. |

| 7. Needs satisfied. | Mostly physical | Mostly socio-emotional including the need for validation, belonging, and knowing. |

| 8. Durability. | Mostly nondurable or used infrequently. | Mostly durable or if nondurable, used frequently. |

| 9. Certification. | Arm’s length agencies empowered with regulatory and inspection duties. | Within the relationships associated with the good’s production, consumption, or exchange. |

Two setting for exchanging relational goods

There are two types of relational good exchanges. In the first type of exchange, the focus is on the relationships, and goods exchanged are mostly SEG. In the second type of exchange, the focus is on the good exchanged that is almost always an AVG, a tangible thing embedded with SEG.

Exchanges focused on relationships. In relationship focused exchanges, SEG are exchanged directly between persons in social capital rich relationships and require no object besides the persons involved in the exchange to complete the transaction. For example, two persons with strong feelings of affection for each other may express those feelings, SEG, in any number of settings including meals, cultural events, conferences, religious gatherings, or work settings. And if there is an object exchanged, it is incidental to the exchange of SEG.

Exchanges focused on objects. In object focused exchanges, AVG are exchanged, things or objects embedded with SEG. AVG result from prior or anticipated connections between social capital rich persons in which SEG are produced and embedded in objects. AVG are most likely a durable. However, AVG may sometimes be non durables that are often exchanged repeatedly such as a meal prepared to celebrate special occasion or a song or dance performed to mark milestones.

Anomalies and Isoutilities

At the beginning of this chapter, we claimed that econs and humans made decisions differently. Sometimes these differences are called anomalies. Furthermore, because many human decisions differ from econ choices, human choices are sometimes called irrational. The claim here is that human choices can appear irrational because relational goods are excluded from the analysis.

To illustrate how including relational goods in exchanges can resolve important economic anomalies, consider the following example. Suppose a seller has the option of exchanging his farmland with a stranger for a commodity (the market price) or exchanging his farmland with a friend or family member for a combination of commodities and relational goods. If the seller prefers the combination of relational goods and commodities offered by friends and family members to the commodities only offered by a stranger even though the commodities offered by the stranger exceed those offered by friends and family members, we might consider that an economic exchange anomaly has occurred. The seller accepted a lower commodity price from a friend or family member when a higher commodity price was available from a stranger. This is only an anomaly if the relational goods included in the exchange are ignored.

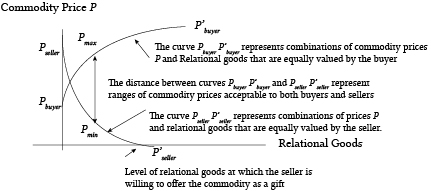

To explain further how including relational goods in exchanges can resolve anomalies, we consider the concept of an isoutility line. Suppose that a decision maker is offered alternative combinations of two goods, a commodity and a relational good. Furthermore, allow that the amounts of the commodity and relational good can be exchanged at some rate that leaves the well-being of the decision maker unaffected. The combinations of relational goods and commodities that leave the decision maker’s well-being unaltered are referred to isoutility combinations and are represented in Figure 21.1 as PbuyerPbuyer. Curve PsellerPseller represents the seller’s isoutility combinations of relational goods and commodity prices.

Figure 21.1. Combinations of Commodity Prices and Relational Goods that Leave Buyers’ and Sellers’ Well-Being Unchanged.

The implication of the graph in Figure 21.1 is that as more of a relational good is received, the seller (buyer) would be willing to accept (offer) a lower (higher) commodity price without suffering a loss in well-being. Furthermore, as relational goods are included in the transaction, the range of commodity prices acceptable to both buyers and sellers increases which also increases the likelihood that persons rich in social capital will exchange. For example, in Figure 21.1 persons without social capital would not trade since, with no relational goods exchanged, the minimum sell price is above the maximum bid price.

In one of the first studies designed to test the influence of relationships on terms and level of exchange, Robison and Schmid (1989) asked faculty and graduate students what would be their minimum sell price of a used car to people who offered them various levels of social capital. Since the Robison and Schmid article was published, the essence of the study has been repeated multiple times with similar results. A recent unpublished survey by Richard Winder found the results reported in Table 21.2. The mode of the distributions of responses by relationship are in bold.

Table 21.2. Average minimum sell price for a used car with a market value of $3,000 reported by 600 survey respondents.

| Nasty neighbor | Stranger | Friend | Family | |

| > $3,500 | 65 | |||

| $3,500 | 263 | 39 | 2 | |

| $3,250 | 21 | 33 | 5 | 1 |

| $3,000 | 236 | 476 | 122 | 29 |

| $2,750 | 11 | 30 | 135 | 24 |

| $2,500 | 4 | 22 | 298 | 199 |

| < $2,500 | 38 | 348 |

Notice that in the absence of social capital (exchanges with a stranger), the distribution of minimum sell prices centers around the commodity exchange price of $3,000. However, when the exchange is conducted with a social capital rich partner such as a friend or family member, the minimum sell price is significantly below the market price with a mode of $2,500 for a friend and a mode price below $2,500 for a family member.

Summary and Conclusions

The material covered in this book is intended to provide instructions about how to behave like an econ. We hope you don’t always follow our advice. There are times and places and circumstances when commodity considerations should be softened by social capital and the importance of relational goods. Learning how to make the appropriate trade-offs between commodities and investments in social capital and relational goods, when to behave like an econ versus a human, may be our most important management task. Good luck.

Questions

- By 2013 Bill and Melinda Gates had donated 38 billion dollars to various charities and especially to fight hunger in Africa. They have donated billions more to these causes since. If Bill and Melinda Gates were to have taken the same survey you took at the beginning of the class where “I want a college degree” is replaced with “We donated billions of dollars…”, how do you think they would have answered? To better speak for them, read a brief interview of Bill Gates by Neil Tweedie at: http://www.telegraph.co.uk/technology/bill-gates/9812672/Bill-Gates-interview-I-have-no-use-for-money.-This-is-Gods-work.html. Now answer the survey that follows as though you were channeling either Bill or Melinda Gates by writing the relative importance of each motive using percentages in the blank besides each motive. The sum of the motives must equal 100%.

- _____ We have donated billions of dollars so that we could increase our lifetime earnings and get a better job.

- _____ We have donated billions of dollars so that important people in our lives would be pleased with our achievements.

- _____ We have donated billions of dollars to live up to the expectations we have for ourselves.

- _____ We have donated billions of dollars so we will feel part of different groups to which we want to belong.

- _____ We have donated billions of dollars to help others.

- Consider a hypothetical gas purchase.

- You gas tank holds 15 gallons and is nearly empty. You normally fill up your car with gas at a station on your way home. How many additional miles would you drive to fill up your car with gas if you could save 10 cents per gallon? I would drive an additional ____ miles to save 10 cents per gallon.

- You gas tank holds 15 gallons and is nearly empty. You normally fill up your car with gas at a station on your way home. How many additional miles would you drive to fill up your car with gas at a gas station owned and operated by your favorite uncle? I would drive an additional ____ miles to purchase gas at a gas station owned and operated by my favorite uncle.

- If your answer to parts a) and b) were different from zero, can you explain why?

- Summarize the difference between relational goods and commodities as discussed in this chapter. Please list two commodities and two relational goods that you own.

- An isoutility line describes different combinations of two different goods that provide equal satisfaction. Use the concept of isoutility to explain why you might sell your used car at different prices to a friend, a stranger, a family, member, and someone you disrespect.

- Commodities are sold in the market place, and their prices are determined by anonymous market forces. The terms of trade of relational goods depend on the relationship between persons exchanging them. Give an example in which you have exchanged relational goods in which relationships altered the terms and level of trade. Then give another example in which you have exchanged commodities in which relationships had no influence on the terms and level of trade.

- One could donate one’s blood or blood plasma at a local Red Cross and receive in return a small amount of juice served in a paper cup and possibly a cookie. One could also sell one’s blood at a number of places (the current price is $25 to $60 per bag). Since some people sell their blood for money and others donate it for free, explain the difference in the way these two groups of people dispose of their blood.

- Suppose you needed a medical procedure that required a skilled physician. Assume that a number of equally skilled physicians were available to perform the procedure. Would your choice of a physician to perform the procedure depend on your relationship to the physician? If he were a family friend? If he were a stranger? If you knew the physician only by reputation—that he performed volunteer work in developing countries? If he was rude to his/her patients, inconsiderate to his/her assistants, and lived a lavish life style? For each of the physicians, answer the questions that follow using the scale included in each question:

- If the physician were skilled and a family friend, the likelihood I would select this physician to perform my procedure is:

- Not likely 1 3 5 7 Very likely (circle one)

- If the physician were skilled and a stranger, the likelihood I would select this physician to perform my procedure is:

- Not likely 1 3 5 7 Very likely (circle one)

- If the physician were skilled and someone I knew only by reputation—that he performed volunteer work in developing countries, the likelihood I would select this physician to perform my procedure is:

- Not likely 1 3 5 7 Very likely (circle one)

- If the physician were skilled and someone I knew only by reputation—that he was rude to his/her patients, impatient with his assistants, and lived a lavish lifestyle, the likelihood I would select this physician to perform my procedure is:

- Not likely 1 3 5 7 Very likely (circle one)

- If the physician were skilled and a family friend, the likelihood I would select this physician to perform my procedure is:

- If you were equally likely to select one of the physicians described in question 7, explain why. If you were not equally likely to select one of the physicians described above, explain why.